How the changes to Kupat Cholim Siudi plans impact you

By Danny Newman, Branch Manager of Beit Shemesh, Goldfus Insurance

When the conversation of long term care insurance arises, many people (especially those in their younger years) dismiss the idea of the policy as irrelevant. However there are many advantages to purchasing a long term policy at a younger age. Before exploring the financial benefits, it is important to understand the policy itself.

Who is considered a long term care recipient by the private insurance companies?

With private insurance plans, the qualification for care is based on the inability to perform 3 out of 6 ADLs (Activities of Daily Living) or 2 out of 6 ADLs if one of them includes incontinence (with certain companies):

- Standing up and lying down

- Dressing and undressing one’s self

- Bathing

- Eating and drinking

- Toileting / continence

- Walking unaided

Irrespective of the number of aforementioned ADLs, should one suffer from cognitive impairment – such as Dementia or Alzheimer’s – the insurance company will also deem the individual as a long term nursing care recipient.

In order to activate the policy, the insurance company will allocate a medical professional to carry out an assessment and ascertain if the client is indeed eligible.

How much do I need to insure myself for?

There are two long term care options currently available in Israel:

- Home care, which is support and care given within the comfort of one’s home

- Nursing home care

The total cost for home care, including associated extras, is approximately 7,000-9,000 NIS per month. The cost for a private nursing home can often reach in excess of 15,000-20,000 NIS per month. Insuring oneself with those figures in mind should provide adequate cover if the policy is needed.

I thought the Kupat Cholim cover Long Term Care via their Siudi policies?

Whilst the Kupat Cholim do offer long term care policies, it is not automatic coverage. The policies are provided by external private insurance companies, and one must apply and receive approval for the cover to be activated. In the past, the long term care coverage varied from Kupah to Kupah, but recent changes have created uniform coverage for all new members.

What are the recent changes to Kupat Cholim policies?

As of 1st July 2016, cover by the various Kupot Cholim has changed, including the levels and amounts of cover.

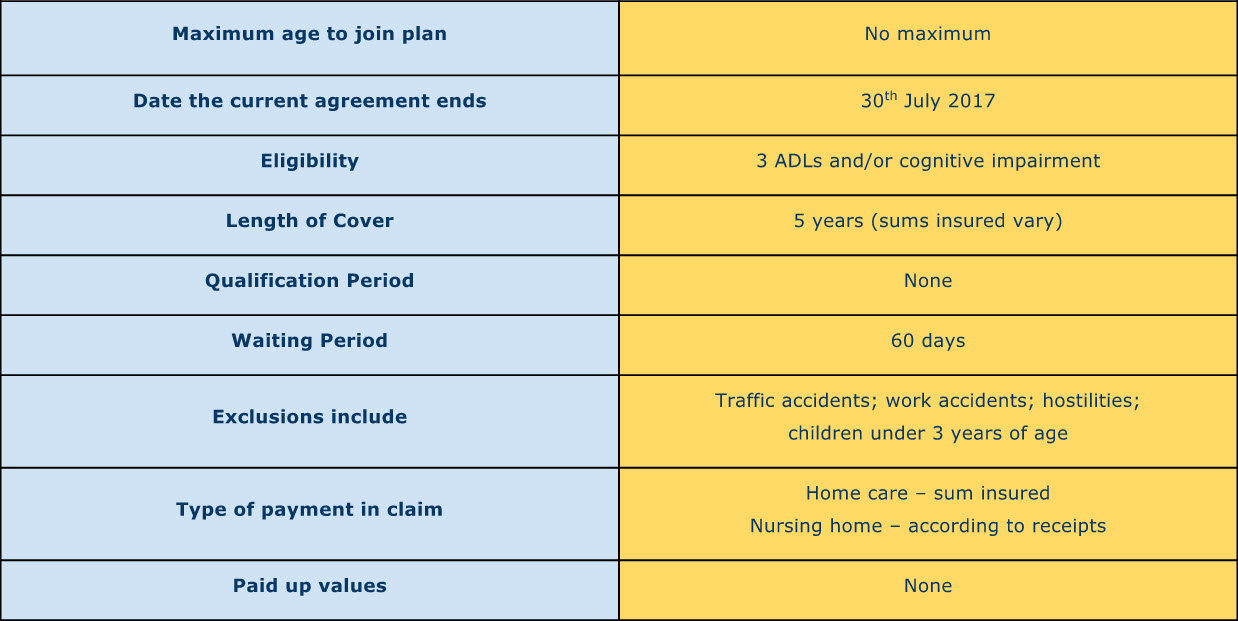

The table below is a summary explaining the main elements of the new policies which apply to all four Kupot Cholim:

What is the level of cover for new members joining after 1st July 2016?

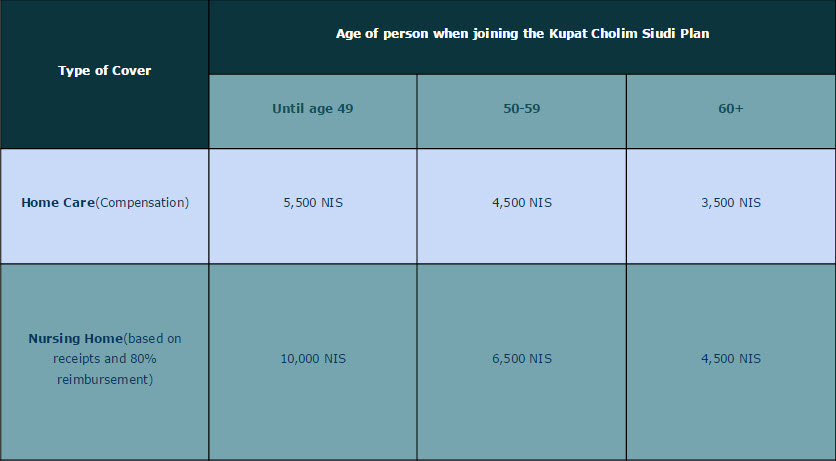

For new members, the level of cover will be dependent on the entry age of the person into the plan as indicated in the table below:

It is important to note that in certain circumstances, the sums insured with each Kupat Cholim may be slightly less than indicated in the above table, dependent on the type of policy one had prior to the changes and the age they were when they initially signed up for the cover. It is best to check with one’s Kupah in order to determine the sums insured they will receive in the event of a claim.

For existing members of a Kupat Cholim siudi plan prior to 1st July 2016, the maximum level of cover will be no higher than the sums insured which are outlined in the table above for new members.

The Kupat Cholim plans provide limited cover in terms of financial pay out. In addition, they only provide cover for the first 5 years should one become a long term care recipient. How do I supplement the difference?

The insurance companies provide a range of private policies, allowing them to be structured according to anticipated needs. For example, one can either purchase plans to cover the life span of a long term care recipient; choose a plan for a limited number of years; or a policy that starts after a predetermined number of years. The latter option is known as a deferred policy. The idea behind the deferred policies is to allow the insured to have the private plan start once the Kupat Cholim plan stops paying; or to self insure a pre-determined period, to reduce the cost of the premiums.

Depending on the type of Siudi policy you are considering, a number have a fixed premium, meaning the premiums are locked in at the rates according to one’s age when initially signing up. It is for this reason that the younger one enters a policy the financially smarter the decision may be.

What is the best option for me?

Whilst the level of cover and length of potential pay out in the event of a claim may be limited within the Kupat Cholim siudi policies, the cost of this plan for many, make this a good financial base on which to build a long term care portfolio. Private plans provide solutions which allow individuals to supplement the coverage offered by the Kupot Cholim.

With increased longevity leading to a greater number of long term care recipients, the need for long term care policies is growing. As a result of the greater number of claims, prices for new private policies continue to increase on a regular basis. Reviewing the level of cover one has with the Kupat Cholim together with the various supplementary private options together with an insurance professional, can ensure one has adequate level of cover at the most appropriate cost.

For more information about Long Term Care policies, contact us today!

Pingback:meditation music

Pingback:soft jazz

Pingback:christmas jazz instrumental

Pingback:sleeping music

Pingback:lakeside cafe

Pingback:smooth jazz

Pingback:best of jazz

Pingback:relaxing music for stress relief

Pingback:yoga music

Pingback:jazz cafe

Pingback:musica de treino

Pingback:bossa nova cafe

Pingback:soothing piano

Pingback:cafe bossa nova

Pingback:������

Pingback:EndoliftX

Pingback:บริการรับสร้างบ้าน

Pingback:Jaxx Liberty

Pingback:รับจัดงานอีเว้นท์

Pingback:dultogel

Pingback:ทำความรู้จักกับ เว็บ บาคาร่า วอเลท

Pingback:dark168

Pingback:HArmonyCa

Pingback:Nonameauto

Pingback:ของพรีเมี่ยม

Pingback:couples massage

Pingback:n-ethylpentedrone kopen | buy 2mmc | 6 apb pellets | buy 5-mapb | deschloroketamine | 4-mpd (4-methylpentedrone) | 6 apb powder | 2-mmc pellets, 5-mapb | 2-mmc crystalline powder | 4bmc poeder | acheter 3-me-pcp | buy cathinonen | buy 6 apb powder |NEP N-

Pingback:เว็บพนันออนไลน์ ต่างประเทศ Baki168

Pingback:slot99

Pingback:스포츠 토토 사이트 추천

Pingback:โคมไฟ

Pingback:สล็อต888 เว็บตรง

Pingback:face exercise

Pingback:ufabet777

Pingback:สล็อตวอเลท

Pingback:Gumbo Strain

Pingback:fast-paced crash game

Pingback:laprensave.com

Pingback:นำเข้าสินค้าจากจีน

Pingback:Japan Auction Sheet Verification

Pingback:เช่ารถเครน

Pingback:1win apk

Pingback:generique kamagra pharmacie au rabais nouveau brunswick

Pingback:enclomiphene online no script

Pingback:buying androxal generic when will be available

Pingback:discount dutasteride generic cheapest

Pingback:cheap flexeril cyclobenzaprine generic order

Pingback:how to buy fildena generic equivalent

Pingback:cheap gabapentin purchase generic

Pingback:cheap itraconazole generic uk buy

Pingback:buy cheap staxyn canada over the counter

Pingback:how to buy avodart cheap prices

Pingback:buy cheap xifaxan australia online generic

Pingback:order rifaximin non prescription online

Pingback:koupit online kamagra