Change in Obligatory Pension Contributions – Tikun 16

By Hani Noiman, Director of Pension Department, Goldfus Insurance

In 2008 new regulations were fixed obligating employers to contribute into a compulsory pension account (policy or fund) for their employees. These regulations (known as Pensiat Chova/Tzav Haharchava) state that the contributions would increase every year on a sliding scale until 2013. In 2014 the Pensiat Chova contributions were increased to their current levels: 6% employer’s contribution to Pitzuim (severance pay), 6% employer’s contribution to Tagmulim (pension and insurance contributions) and 5.5% employee’s contribution to Tagmulim.

The minimum obligation on an employer to provide social benefits for the Pensiat Chova is based on Sachar Hakovea, which itself is based on Sachar Memutza Bameshek– the fixed average salary in Israel. This salary calculation is updated annually for insurance purposes and for the 2016 tax year currently stands at 9,464 NIS per month. In other words, an employer who provides only the legal minimum pension benefits to an employee who is earning 15,000 NIS per month, is required to by law to contribute on a Sachar Kovea of 9,464 NIS per month for the current tax year.

There are a large number of employers who have been providing social benefits to their employees for many years irrespective of the legal minimum requirements. Many do this in order to provide better employment conditions for their employees and to protect from any potential severance pay liability.

As of 2009, an employer is obligated to provide pension benefits for all new employees on the following basis:

- An employee who joins the company with an existing active pension plan in Israel: A pension fund will begin after 3 months of employment, retroactive to the first day of employment.

- An employee who joins the company without an existing active pension plan in Israel: A pension plan will begin after 6 months of employment. There is no obligation on the employer to pay retroactively for the first 6 months of employment.

On 5th February 2016, the law of the Supervision of Financial Services known as Tikun 12 (Amendment 12) went into effect. Part of this law required amendment of Section 20 of the Provident Fund Law, stipulating that an employee will have complete freedom of choice with regards to choosing their pension product.

The amendment states that there will be a uniform percentage for pension contributions for an employee, regardless of the type of pension product chosen by the employee. In other words, the employer will be “indifferent” as to the type of plan chosen by the employee as the deposit percentages will remain the same.

In order to clarify the provisions of Tikun 12 and to reduce the costs to the employer, an agreement was signed between the Histadrut and employers’ organizations, which regulated an increase in contribution deposits in two phases. On the basis of this agreement, in April of this year, the amendment to Tikun 12 was publicized, known as Tikun 16 (Amendment 16).

Tikun 16 went into effect as of 1st July 2016 according to this updated agreement.

Main points of the agreement, increasing pension insurance contributions:

- The agreement states that the amendment will be extended to all employees in the workforce.

- The agreement will apply to the relevant salary (as per Sachar Hakovea, see above) of the employee and subject to the agreement applicable to him/her, but no less than the predetermined salary according to the compulsory pension (Pensiat Chova).

- Changes to the contributions will be according to the collective agreement / Tikun 16.

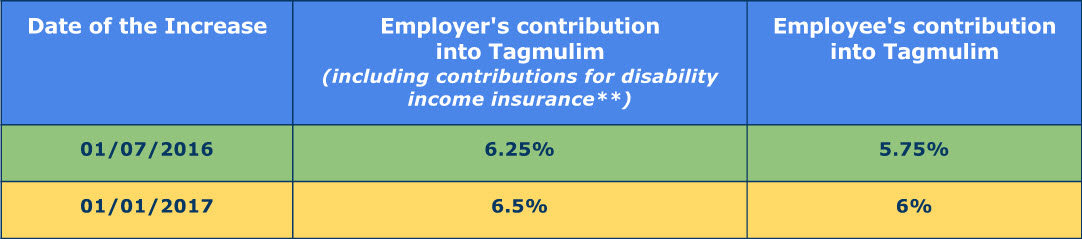

The level of employer and employee contributions to the Tagmulim component of the pension, irrespective of whether the employee has a Keren Pensia (Pension Fund) or a Bituach Menahalim (Manager’s Insurance Fund) will increase in two phases as follows:

** Disability Income Insurance – Should an employer be paying into an insurance fund (Bituach Menahalim) or a provident fund (Kupat Gemel) that is not a Keren Pensia pension fund, the employer payment will include a contribution towards Disability Income Insurance at the rate needed to cover 75% of the employee’s salary. However, irrespective of the rate of this insurance, the Tagmulim payments of the employer should not be lower than 5%, and the total combined employer contribution for both the Tagmulim and the Disability Income Insurance shall not exceed the maximum contribution rate of 7.5%.

It should be noted that for those who have older Pension funds known as a Keren Pensia Vatika, the contributions remain unchanged as required by law:

- 6% Pitzuim

- 7.5% Employer contributions to Tagmulim

- 7% Employee contributions to Tagmulim

- Contributions into Pitzuim (Severence component of the Pension plan)

Contributions shall be as determined in the employment agreement or the law that applies to the employer, not less than 6% of the salary on which the contributions are based.

Existing employees who have a different deposit rate into the Pitzuim (severance pay) component depending on the type of pension product they have, the employer shall be entitled to change the compensation component under the following conditions:

- The percentage shall not be lower than 6%.

- No detriment will be caused to an existing employee’s contributions.

New (future) employees – the employer may set the percentage of compensation to Pitzuim at 6% for all types of pension products, unless there is a new employee who has an existing pension product with a higher rate. Should this be the case, it is incumbent on the employer to pay according to the highest rate of the policy.

Application of Chapter 14 – Se’if 14– The agreement states that “the application of Se’if 14 does not to detract from the rate deposited into the Pitzuim component according to agreements applicable to the employee, prior to the commencement of the agreement, including those with respect to Se’if 14, regardless of the type of pension plan the Employee has.”

Since the agreement was based on an expansion of the compulsory pension Pensiat Chova, it can be understood that the intention of the legislation was to apply the provisions of Se’if 14 to the Severance Pay Law. However, there is no unequivocal interpretation regarding this. In other words, it is unclear exactly how an employer should deal with Pitzuim contributions of a new employee who has a higher percentage rate for the Pitzuim component in their existing policy from their previous employer and how Se’if 14 relates to anything above the original 6% prior to the amendments.

Conclusion

Although the provisions of the agreement and its expansion to all workers in the workforce are now in effect, there are still many issues open to interpretation. There are various opinions that interpret the agreement differently.

As a result of this divergence of opinion, it is recommended that each employer, consult with a lawyer specializing in labour law, to receive appropriate guidance and interpretations that are suitable to the employment agreements used in your organization.

Similarly, adequate preparation is required in order to implement the requirements of Tikun 16, and should be done so in consultation with your insurance agent.

For more information please contact us!

Pingback:hip hop

Pingback:study music

Pingback:relax

Pingback:smooth jazz

Pingback:coffee shop music

Pingback:morning jazz

Pingback:soothing music

Pingback:soothing piano music

Pingback:calm piano music

Pingback:healing music

Pingback:sleeping music

Pingback:chill jazz

Pingback:jazz coffee

Pingback:smooth bossa nova jazz

Pingback:jazz music

Pingback:ตู้เชื่อม

Pingback:โคมไฟ

Pingback:แทงหวยเวียดนาม กับ LSM99 มั่นใจได้เงินจริง

Pingback:ทางเข้า lucabet

Pingback:Scuba diving koh tao

Pingback:ทำความรู้จัก ประวัติ ค่ายคาสิโน allbet

Pingback:marine88

Pingback:ทางเข้าpg

Pingback:Darknet

Pingback:ลดข้าวดีด ข้าวเด้ง

Pingback:tải no789

Pingback:is weed legal poland

Pingback:Food Recipe Video

Pingback:Massage

Pingback:ปั่นสล็อต ด้วยสูตรอัพเดตใหม่

Pingback:happyluke ศูนย์รวม เกมคาสิโน ที่ใหญ่ที่สุด

Pingback:การ์ดงานแต่ง

Pingback:spa in Bangkok

Pingback:เว็บปั้มไลค์

Pingback:Aviator

Pingback:Plinko App

Pingback:hit789

Pingback:สีกันไฟ

Pingback:สล็อต นาจา เว็บตรง ไม่ผ่านเอเย่นต์

Pingback:นวดหน้ายกกระชับ

Pingback:เว็บตรงฝากถอนง่าย

Pingback:snus

Pingback:cheap enclomiphene cheap online no prescription

Pingback:achat kamagra pharmacie envoyer annuaire

Pingback:discount androxal usa price

Pingback:purchase flexeril cyclobenzaprine canada over the counter

Pingback:how to buy dutasteride usa where to buy

Pingback:buy gabapentin uk delivery

Pingback:discount fildena no rx needed

Pingback:get itraconazole cheap trusted

Pingback:online order staxyn cheap buy online no prescription

Pingback:order avodart cheap online no prescription

Pingback:buy xifaxan cheap where

Pingback:discount rifaximin price canada

Pingback:nás. lékárny pro kamagra bez r x